coweta county property tax due date

Sacramento County has property tax rates that are similar to most counties in California. Coweta County GA property tax assessments.

They all are public governing bodies administered by elected or appointed officers.

. This is mostly due to the general tax levy of 1. County Property Tax Facts County Property Tax Facts. If you have documents to send you can fax them to the Coweta County assessors office at 770-254-2649.

Property tax returns must be filed with the county tax office between january 1 and april 1 of each year. Coweta County collects on average 081 of a propertys assessed fair market value as property tax. Failure to have received a tax bill in the mail will not cause late charges to be waived if paid after the due date.

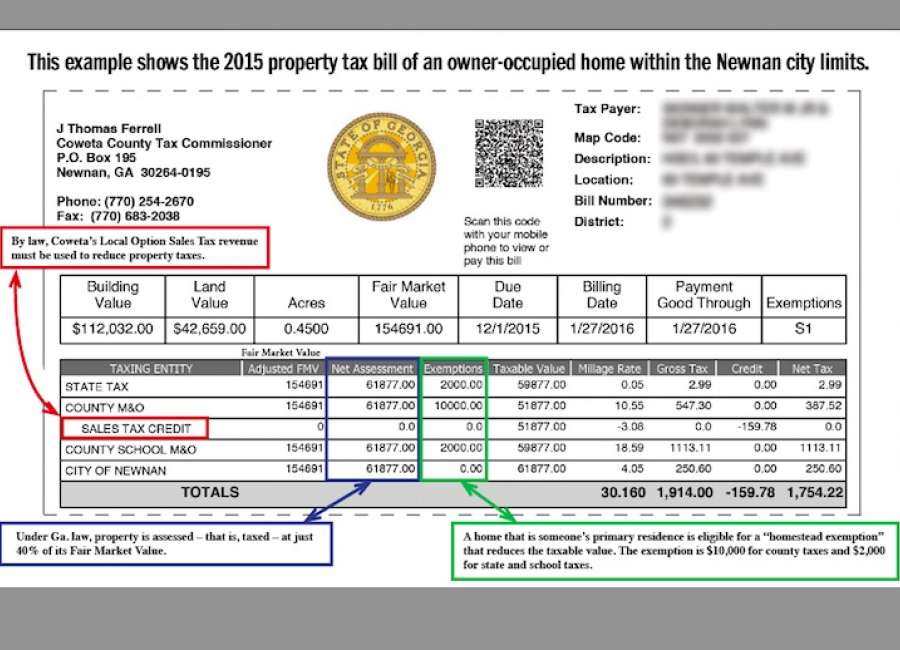

Now all Coweta County residents and businesses receive one tax bill due and payable by December 1st to the Coweta County Tax Commissioner. Property tax bills are based on. Property tax appeals and reassessments.

Beginning in 2015 all Coweta County residents will receive one tax bill annually due and payable to the Coweta County Tax Commissioner by December 1st. Please call the assessors office in Newnan before you send. You can use the search below to find your county information or you.

Georgia is ranked 841st of the 3143 counties in the United States in order of the median amount of property taxes collected. In comparison some Los Angeles residents have tax rates around 119302. 1 of the assessment year for taxes due Jan.

Whether you are already a resident or just considering moving to Coweta County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. The property tax due dates are April 30 and October 1 for the first and second half instalment respectively. Treasurer submits the County Property Tax Collections Calendar Year report to the DOR Research and Fiscal Analysis Division.

Beginning in 2015 all Coweta County residents will receive one tax bill annually due and payable to the Coweta County Tax Commissioner by December 1st. Property tax returns must be filed with the county tax office between January 1 and April 1 of each year. February 1 - Second installment due of Secured Property Taxes.

Pre-registration for this sale will be required. The median property tax on a 17790000 house is 144099 in Coweta County. You can call the Coweta County Tax Assessors Office for assistance at 770-254-2680.

The median property tax on a 17790000 house is 147657 in Georgia. Coweta County GA. Property assessments performed by the Assessor are used to determine the Coweta County property taxes owed by individual taxpayers.

Click here for the Citys current year property tax digest and 5-year history of the levy. This calculator can only provide you with a rough estimate of your tax liabilities based on the property. There are three vital steps in taxing property ie formulating tax rates appraising property market worth and collecting payments.

MARCH 1 Annual mailing of personal property tax bills begins. 2022 Property Tax Calendar. Coweta County residents have a little over a week to pay their 2015 property taxes.

Some property owners in San Diego City have a 117461 tax rate while some in Chula Vista have a rate of 114221. Property owners may contact the Assessment Office for questions about. County tax bills were mailed Oct.

Learn all about Coweta County real estate tax. Coweta County Home Property Tax Statistics. All taxable real and personal property is valued as of Jan.

Grantville Haralson Moreland Newnan Palmetto Senoia Sharpsburg and Turin. The median property tax on a 17790000 house is 186795 in the United States. You should check with your county tax commissioners office for verification.

Second installment of real estate taxes is due delinquent after 500 PM on April 10. Please note that the City of Newnan will continue to collect all delinquent City taxes for years 2014 and prior. The City of Newnan will no longer bill and collect city taxes seperately.

Property tax rates. 1 and payable in the following tax year RCW 8436005 and RCW 8440020. The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900.

APRIL 10 Second installment of real property taxes becomes delinquent after 500 PM. Beginning at 1000 am on the first Tuesday in September 2021 the same being September 7 2021. Paying property tax bills and due dates.

The below listed and described properties or as much thereof as will satisfy the State and County tax execution on. 1 and taxes are due Dec. Visit your countys official website or Department of Revenue and make an electronic payment to avoid queuing and waiting.

Taxing authorities include Coweta county governments and numerous special districts eg. FEBRUARY 15 Deadline for filing homeowners exemption claim 7000 assessment. Coweta County property taxes are due Dec.

Remember to have your propertys Tax ID Number or Parcel Number available when you call. Even though the official due date for ad valorem tax payment is December 20th the local governing authority may adopt a resolution changing the official due date for tax payment to December 1st or November 15th or may implement installment billing with multiple due dates. April 10 - Second installment payment deadline - a 10 penalty plus 1000 cost is added to payments made after this date If a delinquent date falls on a weekend or holiday the delinquent date is.

Tax Due Dates Contact Us Subscribe to Revenue Emails Careers.

Coweta Living 2017 2018 By The Times Herald Issuu

Newnan Georgia Ga 30265 30277 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Newnan Coweta Magazine Home Facebook

Special Election For One Cent Sales Tax Increase Happening Again In Coweta News Tulsaworld Com

Business License Renewal Coweta County Government Facebook

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

Coweta School Board Approves 2021 22 Budget Winters Media